COVID-19 Business Resources

The Partnership is here to help provide the most up-to-date information on health and safety guidance, financial resources and programs available to keep your business strong during uncertain times.

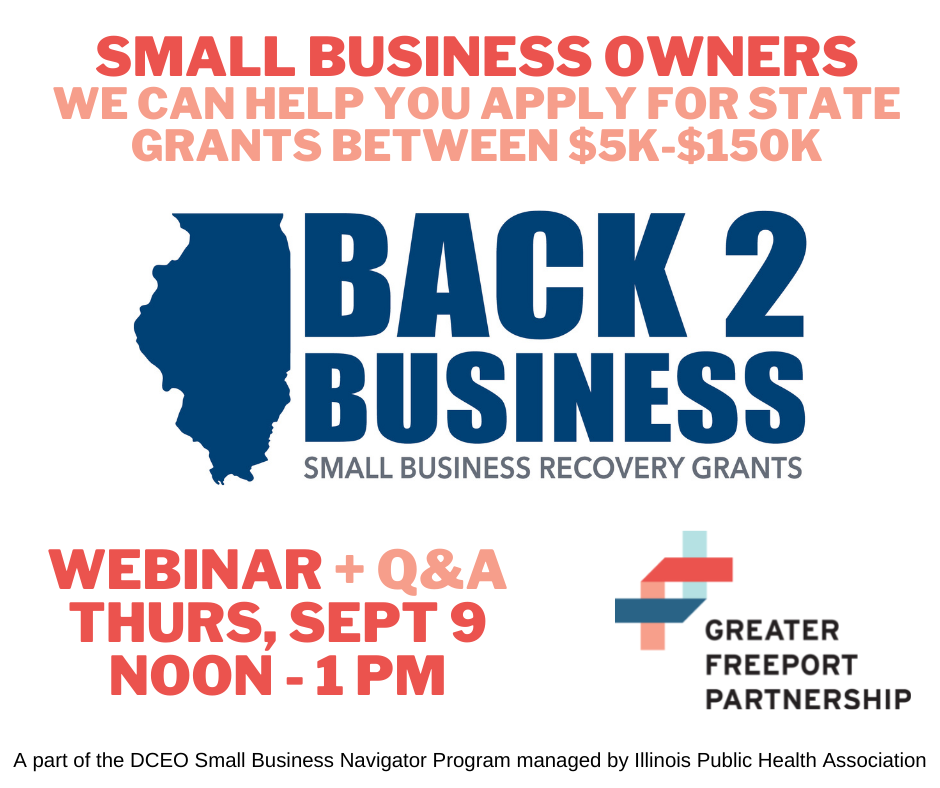

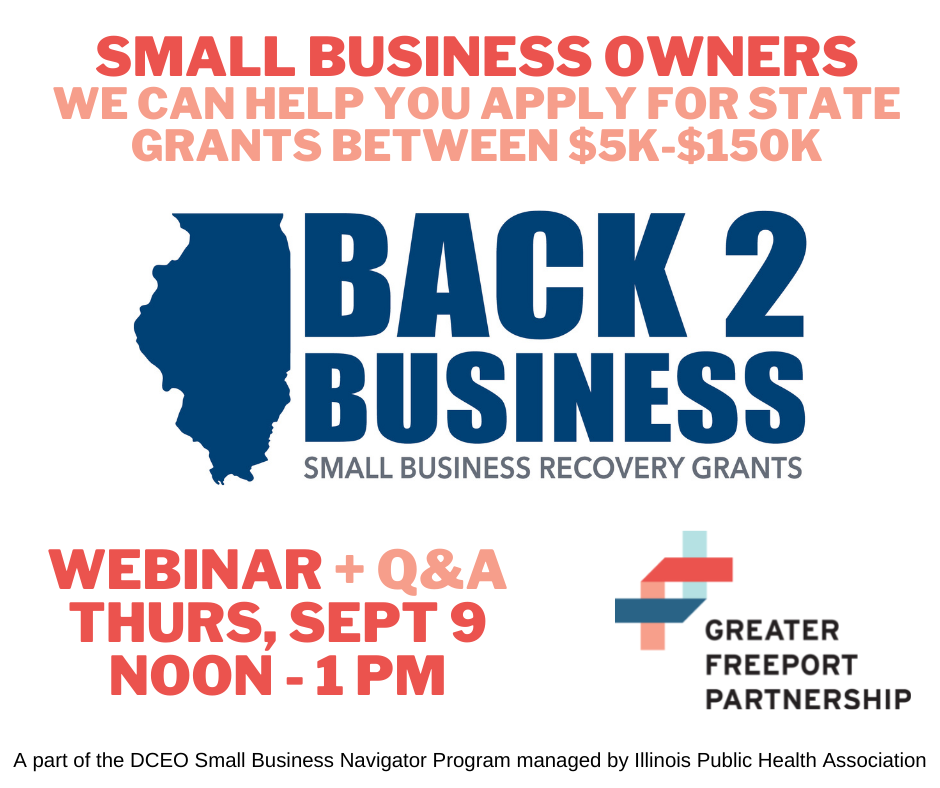

Back to Business Grant Program Overview

The Back to Business (B2B) grant program is a key component of Governor JB Pritzker’s $1.5 billion economic package designed to maximize the impact of American Rescue Plan Act funds provided to Illinois. It sets forth $250 Million for businesses that have experienced losses due to the COVID-19 pandemic to support them in their recovery.

Here’s What You Need to Know.

- $5,000-$150,000 grants to cover operations/staff/overhead costs.

- Must have revenues of $20 million or less in 2019 and a reduction in revenue in 2020 due to COVID-19.

- Priority given for these businesses applying:

- Hardest hit industries – such as hotels, salons, fitness centers, restaurants, and more.

- Disproportionately Impacted Areas (DIAs) – economically distressed communities which have had higher case counts of COVID-19. Click here for a link to the DIA map.

- Businesses who have yet to qualify for state or federal assistance, including the Paycheck Protection Program (PPP), Restaurant Revitalization Fund (RRF), BIG, and more.

Application is fast and easy!

- New interface designed to help small business owners track and learn updates on their application status in real-time

- B2B application portal at www.illinois.gov/dceo

- What You need:

- A copy of your business’s 2019 AND2020 Federal tax returns

- Two business bank statements – one from the period March through December 2020, and your most recent statement

- Business owner ID (ITIN accepted)

Webinar Recording can be found here.

Questions?:

- Help is available. The Greater Freeport Partnership will serve as the Small Business Navigator for this grant program and is available to help answer your program questions and provide assistance with your application. If you have immediate questions, please contact the Partnership office, 815-233-1350.

Partnership Panel – COVID-19 Webinar Series

July 15, 2020

Topic: – New Laws for Business & Sexual Harassment Requirements – Sen. Brian Stewart and Beth Maskell

Meeting Recording Here

Webinar Slides

Sexual Harassment Training by Furst Staffing, click here

Sexual Harassment Training by Hughes Resources contact Carolyn Mitchell, Director of Sales and Marketing, for additional details. carolyn@hughesresources.com or call 815-232-2000

June 19, 2020

Topic: – Freeport Clean Hands, Open Doors with Nicole Haas, Greater Freeport Partnership

Meeting Recording Here

Password: 4J*%k14i

June 12, 2020

Topic: – Growing in Tough Times: Thinking like a Startup, Richard Lamm, Lucas Group CPAs

Meeting Recording Here

Password: 4S%4946u

May 7, 2020

Topic: – Business Survival Coaching: Using Downtime as Growtime

Meeting Recording Here

Password: ab010834!

Other Financial Resources

Spanx and The Spanx by Sara Blakely Foundation, administered by Global Giving, are providing 1,000 grants of $5,000 to women-owned small businesses affected by COVID-19 in monthly rounds. The application will open again From September 8-15.

Lurn: The company’s COVID-19 Relief Fund will help entrepreneurs and small business owners by providing emergency grants ranging from $50 to $500 to help with necessities such as groceries, medicine, transportation, etc. To date, it has raised over $50,000 and dispersed roughly $32,000 in emergency relief grants to individuals.

Mailchimp: $10 million worth of service will be offered for existing customers who want to continue using Mailchimp’s platform but need some financial support during this period. As an additional response to the crisis, Mailchimp will invest up to $100M to help drive new and ongoing business for our small-business customers through price discounts, product upgrades, add-ons and more.

Wefunder: The company’s Coronavirus Crisis Loans program enabling small businesses to crowdfund loans of $20,000 to $1 million from supporters.

Zapier: The $1 million assistance program is meant for their most impacted small-business customers. Zapier’s support team will set up qualified customers with a free month credit for a Starter plan.

Thanks to a $1 million grant from Sam’s Club, LISC will provide the emergency assistance that small businesses desperately need to stay afloat. They will deploy grants to help them bridge the financial gap, and deliver technical assistance to help them navigate the intricate web of public and private resources now available. LISC will focus these efforts on historically under-served communities—especially those enterprises owned or led by women, minorities and veterans, which often lack access to affordable capital.

Unemployment & Paid Leave

Unemployment Benefits – Illinois Department of Employment Security (IDES)

For Employee:

- Unemployment Benefits for More Americans: makes sure self-employed and independent contractors, like Uber drivers and gig workers, can receive unemployment during the public health emergency

- Pandemic Unemployment Assistance (PUA)

PUA provides 100% federally funded unemployment benefits for individuals who are unemployed for specified COVID-19-related reasons and are not covered through other avenues in the unemployment insurance program, including self-employed sole proprietors and independent contractors. IDES is contracting with Deloitte to implement and maintain a web-based solution for PUA as quickly as possible. IDES will have this program fully implemented by the week of May 11.

- Pandemic Unemployment Assistance (PUA)

-

- Pandemic Emergency Unemployment Compensation (PEUC)

PEUC Provides up to 13 weeks’ worth of 100 percent federally funded benefits to individuals who have exhausted their rights to regular state unemployment benefits of up to 26 weeks in Illinois. PEUC is potentially available for weeks beginning on or after March 29, 2020 and continuing through the week ending December 26, 2020. PEUC will be retroactive once implemented. IDES received USDOL guidelines on April 10 and expects to have the program fully implemented the week of April 20.

- Pandemic Emergency Unemployment Compensation (PEUC)

Other Helpful Links:

- IDES: I’ve Filed My Claim, What Happens Now?

- IDES: What Every Worker Should Know about Unemployment Insurance.

For Employer:

IDES Resource for Employers.

Paid Leave – Families First Coronavirus Response Act (FFCRA)

FFCRA will help the United States combat and defeat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave, either for the employee’s own health needs or to care for family members. The legislation will ensure that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus while at the same time reimbursing businesses.

- Helpful Links:

IRS: Coronavirus Tax Relief: The IRS has established a special section focused on steps to help taxpayers, businesses and others affected by the coronavirus. This page will be updated frequently as new information is available: https://www.irs.gov/coronavirus.

- Other State Tax Relief during COVID-19. Short-term relief from penalties for late sales tax payments.

Manufacturing Resources

COVIID-19 Task Force Work Instructions

Illinois Manufacturing Excellence Center (IMEC)

- Resources & Information

- If businesses have a facility and are capable of manufacturing PPE or are able to quickly make the switch to manufacture PPE, they should reach out to IMEC here.

- If businesses are manufacturers of PPE looking for a supplier, they should reach out to the Illinois Manufacturing Excellence Center here.

Illinois Manufacturers’ Association (IMA): List of Illinois businesses that are producing PPE

- PPE Donations: If businesses have personal protection equipment (PPE) that they would like to donate, they can send an email to the State of Illinois’ Covid-19 Donation Intake Team (ppe.donations@illinois.gov). Please note that all items should be in the manufacturer’s original packaging and unopened, as they cannot accept open products or homemade items.

- For non-PPE related donations, businesses may reach out to businessdonations@illinois.gov.

- If businesses have PPE that they are interested in selling to the state, they can send an email to the State of Illinois’ Covid-19 PPE Procurement Team (covid.procurement@illinois.gov).

Remote Work Resources & Leadership

Remote Work Resources:

- 10 Tips for Staying Productive Working from Home

- Tools Available for Remote Work Plans

- Emergency Remote Work Plan policy ideas – Harvard Business Review

Leadership Resources: